Banxware / YND – Cash Advance

FinTech · Embedded Financ

Year

2019-2020

Role

Expert UX/UI Designer. Responsible for requirement gathering, UX concept, flows, wireframes, and UI design.

Context and product

Banxware is an embedded finance solution that enables platforms and marketplaces to offer fixed-term loans to small businesses directly within their own products. The system was designed as a white-label platform, adaptable to different lenders, partners, and integration contexts.

At the start of the project, Wirecard was intended to be the main technical and financial partner, providing both real-time data access and the lending infrastructure.

The challenge:

The key challenge was designing a process that feels approachable and understandable, without hiding legal complexity or overwhelming users.

- At least for the start, that was the challenge.

Very problematic problem space

The core challenge was to design a loan product that:

Meets strict regulatory and compliance requirements

Handles highly sensitive financial and personal data

Feels trustworthy, transparent, and understandable to small business users

Midway through the project, the Wirecard scandal fundamentally changed the landscape. The originally planned core partner became unavailable, requiring a strategic pivot without losing momentum, user trust, or the integrity of the product concept.

At the same time, the first intended platform partner, Orderbird, had to withdraw most of its support during the pandemic due to shifting business priorities.

Approach & Process

From the outset, the product was designed to be modular and adaptable:

Requirement gathering across legal, financial, and technical constraints

Structuring the system as a lender-agnostic, white-label solution

Designing user journeys that could survive changes in partners and integrations

Continuous alignment with evolving business realities during the pandemic and partner changes

Design focus and decisions

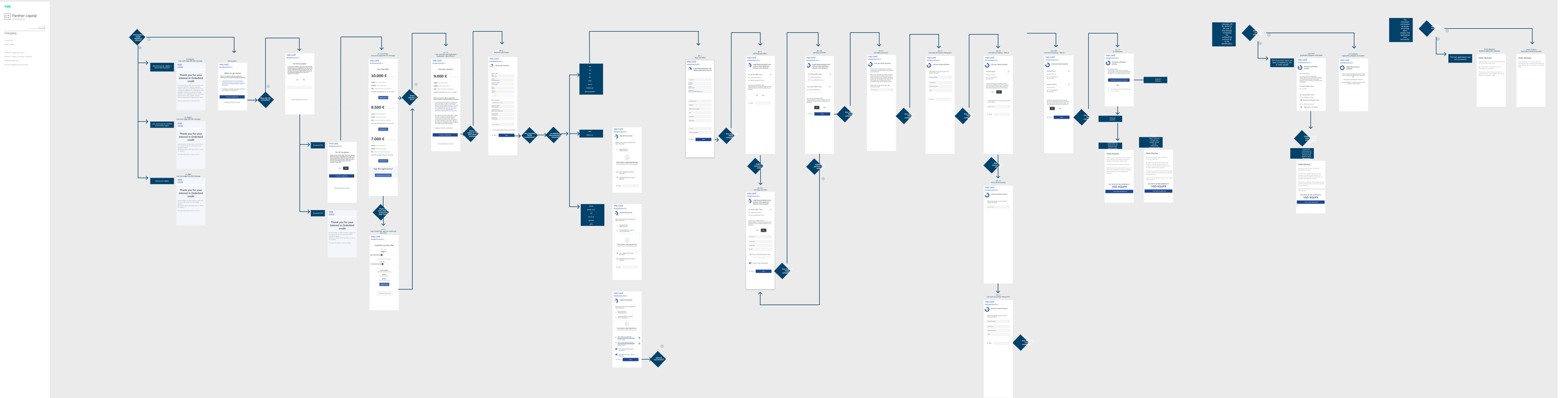

I designed the entire customer lifecycle, including:

Loan application

Clear, step-by-step application flows with transparent explanations of required dataOffer generation

Making loan offers understandable and comparable, despite complex financial logicBack-office approval flows

Interfaces for internal review, approval, and exception handlingCustomer dashboards & repayment views

Clear visibility into repayment schedules, outstanding balances, and status updatesSystem adaptability

Modular UX patterns that allowed the product to be reused with different lenders and platforms without fundamental redesign

A strong emphasis was placed on UX writing, progressive disclosure, and feedback states to maintain trust during a high-stakes financial process.

Outcome and impact

My role

UX/UI Designer with end-to-end responsibility for the user experience across the entire product lifecycle.

Worked closely with:

Product management

Engineering

Compliance and legal stakeholders

External platform and lender partners

Despite the loss of Wirecard as a partner and the initial platform setback with Orderbird, the core concept, UX architecture, and design proved robust.

Because the product was designed as a flexible, white-label solution from the start, it could be successfully adapted to alternative lenders and later re-emerged as the foundation of Banxware’s standalone product, which has since become a successful fintech platform.

This project demonstrated my ability to:

Design resilient systems under uncertainty

Own end-to-end, data-heavy workflows

Balance user trust, compliance, and business adaptability

Think beyond single integrations and design for long-term scalability